2013-05-16 03:05 GMT

BoE sees a modest and sustained recovery over the next three years

The quarterly Inflation Report released by the Bank of England on Wednesday suggests that UK inflation should rise above 3% in June and that it will possibly remain above the 2% target for the next two years. As for the GDP, it is “likely to pick up gradually over the next year or so, supported by past asset purchases, an easing in credit conditions aided by the Funding for Lending Scheme, and a continuing improvement in the global environment.”

The BoE MPC expects GDP growth of 0.3% in the first quarter of 2013. In the current quarter they see quarterly GDP expanding by 0.5%, while year-on-year GDP is projected to grow by 2.2% (compared with the previous forecast of 2%). Nevertheless, the MPC recognizes that the recovery is still “weak and uneven.” The report states that in the light of the growth and inflation forecasts more stimulus might be required. No rate hike should be carried out before 2016 however. Following the release of the report, BoE Governor Mervyn King presented it at a press conference. He pointed out that there are many obstacles on UK's road to recovery, the most important being the Eurozone crisis and rising unemployment. He stressed that UK policymakers should continue their efforts to boost the recovery as “this is no time to be complacent.”-FXstreet.com

|

|

2013-05-15 09:00 GMT

EMU. Consumer Price Index

2013-05-15 12:30 GMT

USA. Consumer Price Index

2013-05-15 14:00 GMT

USA. Philadelphia Fed Manufacturing Survey

2013-05-15 19:05 GMT

USA. FOMC Member Williams speech

|

2013-05-15 19:24 GMT

EUR/USD seen at 1.2600 in 3 months - UBS

2013-05-15 18:55 GMT

GBP/JPY is unable to break above 156.00

2013-05-15 18:41 GMT

USD/CHF retests daily lows

2013-05-15 18:19 GMT

AUD/USD's recovery capped at 0.9920, back to 0.9870

|

|

|

|

|

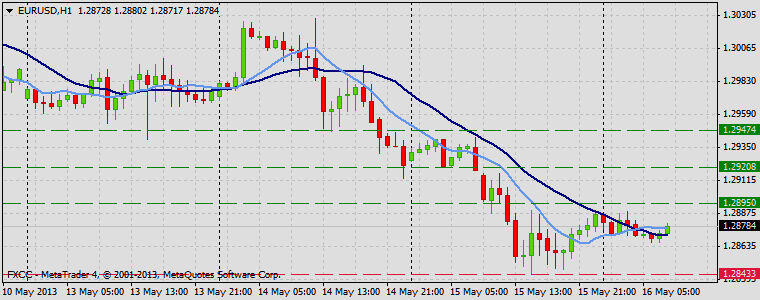

| EURUSD | HIGH1.28889 | LOW1.28663 | BID1.28752 | ASK1.28758 | CHANGE-0.09% | TIME08:32:23 |

|

|

|

OUTLOOK SUMMARY

Down

|

TREND CONDITION

Down

trend

|

TRADERS SENTIMENT

Bearish

|

IMPLIED VOLATILITY

Medium

|

|

|

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: Market sentiment is slightly improved for the bullish oriented traders however further appreciation needs to clear barrier at 1.2895 (R1) to enable our interim target at 1.2920 (R2) and then any further gains would be limited to last resistance at 1.2947 (R3). Downwards scenario: Yesterday session low offers key supportive barrier at 1.2843 (S1). Break here might provide sufficient momentum on the downside and expose our intraday targets at 1.2819 (S2) and 1.2794 (S3)

Resistance Levels: 1.2895, 1.2920, 1.2947

Support Levels: 1.2843, 1.2819, 1.2794

|

| GBPUSD | HIGH1.52476 | LOW1.52154 | BID1.52305 | ASK1.52311 | CHANGE-0.03% | TIME08:32:24 |

|

|

|

OUTLOOK SUMMARY

Down

|

TREND CONDITION

Sideway

|

TRADERS SENTIMENT

Bullish

|

IMPLIED VOLATILITY

Medium

|

|

|

Upwards scenario: Next actual resistance level is seen at 1.5250 (R1). If the market manages to surge higher, our focus will shift to the next target at 1.5285 (R2) and further recovery action could be exhausted at 1.5322 (R3) intraday. Downwards scenario: Market decline below the support level at 1.5194 (S1) might change short-term technical picture and shift market sentiment to the bearish side. In such scenario we expect next targets to be exposed at 1.5161 (S2) and 1.5127 (S3)

Resistance Levels: 1.5250, 1.5285, 1.5322

Support Levels: 1.5194, 1.5161, 1.5127

|

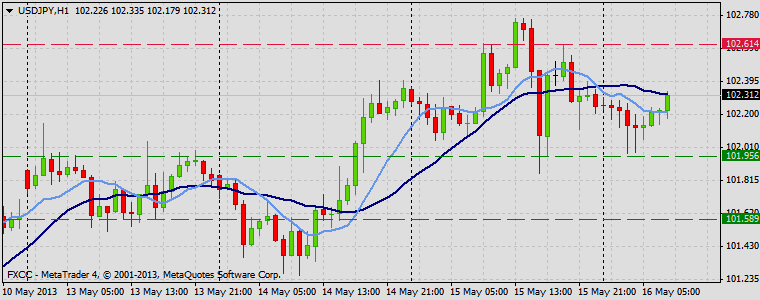

| USDJPY | HIGH102.303 | LOW101.971 | BID102.205 | ASK102.210 | CHANGE-0.04% | TIME08:32:25 |

|

|

|

OUTLOOK SUMMARY

Up

|

TREND CONDITION

Downward

penetration

|

TRADERS SENTIMENT

Bearish

|

IMPLIED VOLATILITY

Medium

|

|

|

Upwards scenario: Our next resistance level is placed at 102.61 (R1). Clearance here is required to resume uptrend structure towards to next target at 102.99 (R2) and any further price appreciation would then be limited to 103.34 (R3) mark. Downwards scenario: However we do expect some consolidation from the recent upside extension. Possible price depreciation is limited to the key support barrier at 101.95 (S1). Decline below would suggest initial targets 101.58 (S2) and 101.21 (S3).

Resistance Levels: 102.61, 102.99, 103.34

|

Disclaimer

The analysis we provide is based on the average estimate of price movements in one day. Does not guarantee what we deliver is actually a proper and correct. Everything that happens in the decisions you make on your trading transaction is to be Your responsibilities.

Visit Us www.deryworldscorp.web.id

Visit Us www.deryworldscorp.asia

Visit Us www.deryworldscorp.web.id

Visit Us www.deryworldscorp.asia

No comments:

Post a Comment